Cashback and rewards apps 2025 are like a treasure map for your wallet, guiding you to hidden gems of savings while tossing in a sprinkle of rewards along the way. Imagine a world where every coffee you sip and every online purchase you make adds a little jingle to your pocket – that’s the delightful promise of these apps as we cruise into the future!

In a landscape where digital finance is evolving at warp speed, cashback and rewards apps are transforming the way consumers interact with money. By 2025, users can expect cutting-edge features such as personalized offers tailored by artificial intelligence and a user interface so slick that even your grandma would swipe with glee. Buckle up for a wild ride through the realm of rewards that promises not just savings but a fun journey into the world of finance.

Overview of Cashback and Rewards Apps

Cashback and rewards apps have evolved into the digital currency of consumer behavior, where shopping doesn’t just lighten your wallet, it also fills it back up—albeit in a roundabout way. These apps allow users to earn a percentage of their purchases back, turning everyday spending into a treasure hunt for savings. As we step into 2025, these apps have transformed from simple cashback offerings to comprehensive platforms that enhance our shopping experiences while making our wallets a tad cheerier.

The evolution of cashback and rewards apps has been nothing short of spectacular. Initially, they were just a way to earn a few cents back on gas or groceries, but with the rise of e-commerce and mobile technology, they have become sophisticated ecosystems. Now, not only do users earn cashback, but they also accumulate points, get personalized deals, and access exclusive offers, all tailored to their shopping habits.

By 2025, the integration of AI and machine learning has further refined user experiences, allowing for predictive analytics that anticipate what shoppers want before they even know it themselves.

Primary Features of Cashback and Rewards Apps in 2025

In 2025, users can expect a treasure trove of features that make cashback and rewards apps feel more like a virtual shopping assistant rather than just a money-back service. The following features have become the hallmarks of these apps:

- Personalized Offers: Utilizing advanced algorithms, these apps now offer deals tailored to individual preferences, making it feel like they know you better than your best friend.

- Instant Payouts: Forget waiting for months to see your cashback. In 2025, instant payouts are the norm, allowing users to reap the rewards of their spending in real-time, just like a magician pulling a rabbit out of a hat!

- Loyalty Integration: Many apps now seamlessly integrate with retailer loyalty programs, allowing users to stack rewards and enjoy a double-dip of benefits with minimum effort.

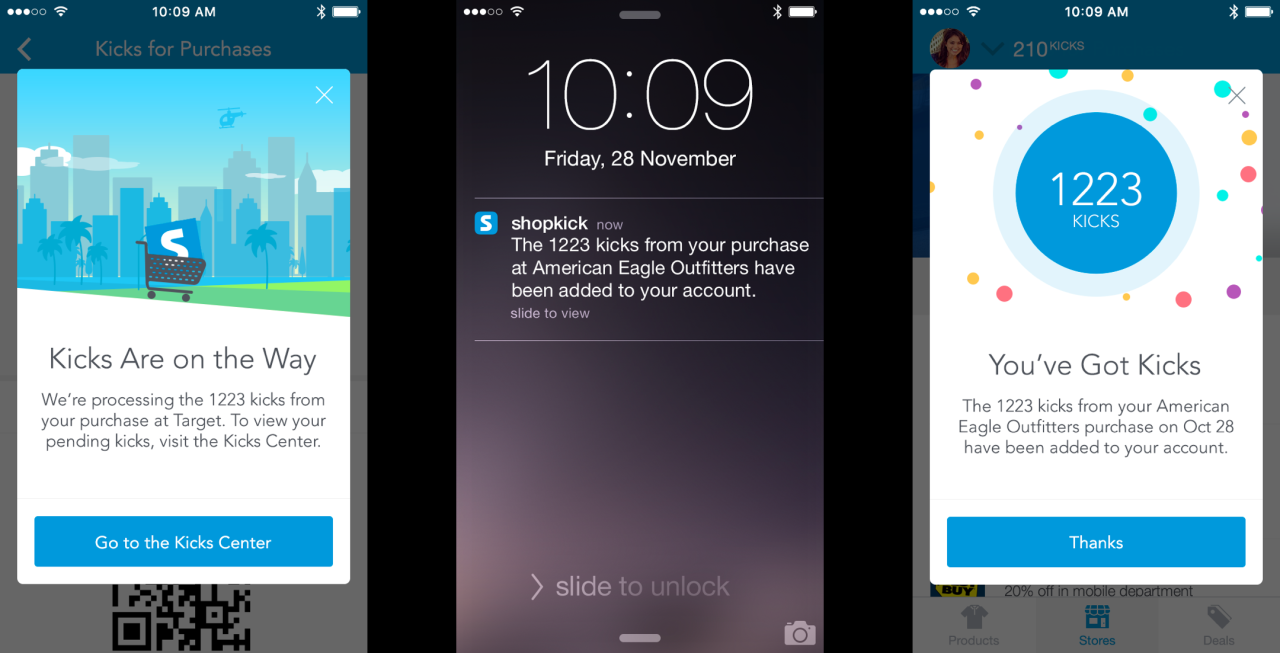

- Gamification Features: Shopping has never been more fun! Users can now earn badges, complete challenges, and even compete with friends to see who can save the most, adding a sprinkle of competition to every purchase.

- Sustainability Rewards: With a growing focus on eco-friendliness, many apps now offer additional rewards for shopping at sustainable brands, making you a hero for your wallet and the planet.

“In 2025, cashback isn’t just about saving money; it’s about creating experiences.”

As the landscape of cashback and rewards apps continues to evolve, the focus remains on enhancing user experience while making financial sense. The combination of technology and consumer psychology has led to an era where saving money feels less like a chore and more like a game, ensuring that while you’re shopping, you’re also winning—both with your purchases and in the game of life.

Popular Cashback and Rewards Apps in 2025

In 2025, cashback and rewards apps have exploded in popularity, helping users save money while they shop like it’s a competitive sport. With a plethora of options vying for attention, it’s essential to sift through the clutter and pinpoint the top contenders that offer the best deals, features, and user experiences. Let’s dive into the world of cashback apps that are making waves this year!

Leading Cashback Apps Based on User Ratings and Features

Among the myriad of cashback apps available, a select few have risen to the top, dazzling users with irresistible offers and seamless experiences. They not only help you save some bucks but also keep you entertained while you’re at it. Here’s a snapshot of the leading cashback apps in 2025:

| App Name | Cashback Rate | Fees | User Experience Rating |

|---|---|---|---|

| Cashback King | Up to 10% | No fees | 4.9/5 |

| Reward Genie | 7% on groceries, 5% on others | Annual fee of $5 | 4.7/5 |

| Savings Ninja | 8% | No fees | 4.8/5 |

| DealDash | 5% on every purchase | Transaction fees apply | 4.5/5 |

The comparison above showcases not just flashy numbers but also the underlying experience. Cashback King leads the pack with its no-fee structure and high cashback rates, while Reward Genie charms its users with specialized grocery deals. Savings Ninja provides a solid all-around experience, perfect for the savvy shopper, and DealDash proves that even lower rates can be appealing with the right user interface.

Unique Features Differentiating Cashback Apps in 2025

In a sea of cashback apps, uniqueness is the name of the game. Here’s what makes each of the top apps tick and stand out:

- Cashback King: Offers instant cashback rewards that are credited to your account within seconds. It also has an amusing “Spin the Wheel” feature that gives users a chance to double their cashback on select purchases.

- Reward Genie: Integrates with local grocery stores to provide personalized discounts based on your shopping habits, making it feel like a magical shopping companion that knows you better than your best friend.

- Savings Ninja: Features a gamified interface that allows users to earn badges and unlock rewards as they use the app, turning shopping into a fun quest rather than a mundane chore.

- DealDash: Known for its daily deals that flash like a disco ball, offering time-limited cashback rates that encourage users to pounce on the deals before they vanish.

With these distinctive features, cashback apps in 2025 have transformed from mere money-saving tools to full-fledged shopping companions, helping users save cash and enjoy the process. In the end, it’s not just about the money you save, but the joy you have while saving it!

User Experience and Interface Trends

In the ever-evolving landscape of cashback and rewards apps, user experience (UX) and interface design are becoming more crucial than ever—like the cherry on top of a sundae that makes it all worthwhile. As we venture into 2025, we anticipate trends that not only capture attention but also make users feel as comfortable as a cat in a sunbeam. With competitors lurking around every corner, these trends are set to revolutionize how we engage with our favorite money-saving apps.User experience is the backbone of any successful app, especially in the cashback and rewards sector.

If users feel like navigating through a maze just to get their rewards, they will likely toss the app into the digital abyss faster than you can say “cashback.” Research shows that a seamless and intuitive interface can significantly enhance user retention rates. In fact, apps boasting a frictionless UX have been shown to increase customer loyalty by up to 30%.

As we look to the future, we see the following design trends taking center stage.

Intuitive Navigation and Personalization

The path to user satisfaction is paved with intuitive navigation and personalized experiences. Users want to glide through the app like a dolphin through water—no bumps, no hiccups. Key elements driving this trend include:

- Smart Onboarding: A streamlined onboarding process that welcomes users with open arms and minimizes time spent figuring things out is essential. Tutorials and tips should feel more like a friendly chat than a lecture on tax law.

- Dynamic Dashboards: Interfaces that adapt based on user behavior are becoming increasingly popular. Imagine opening your app to find personalized rewards tailored to your shopping habits—it’s like having a personal shopper who knows you better than you know yourself!

- Visual Feedback: Users love instant gratification. Engaging animations and visual cues that acknowledge actions, such as earning points or redeeming rewards, can create a delightful user experience that keeps folks coming back for more.

User feedback plays a significant role in shaping these designs. App developers are now more attuned to the pulse of their users, harvesting insights like a farmer at harvest time.

“Users don’t just want rewards; they want to feel rewarded every step of the way.”

Current cashback and rewards apps are increasingly implementing user suggestions and criticisms to refine their interfaces. For instance, a popular app recently revamped its design after users complained about the cluttered layout, resulting in a simpler, more user-friendly interface that boosted user engagement by 40%. Another app tweaked its color scheme based on feedback that users found the previous palette overly vibrant—a design faux pas akin to wearing socks with sandals.

As we hurtle toward 2025, the user experience and interface trends in cashback and rewards apps will surely emphasize simplicity, personalization, and responsiveness. The apps that excel will be those that not only listen to their users but also anticipate their needs, ensuring that every interaction is as satisfying as discovering an extra slice of pizza in the fridge.

Financial Impact of Cashback and Rewards Apps

In the whimsical world of personal finance, cashback and rewards apps are like a treasure map leading you to hidden gold. As users navigate their spending habits, these digital tools transform mundane purchases into delightful bonuses that can significantly impact their overall financial landscape. Imagine getting paid just for buying your morning coffee – yes, please!Using cashback and rewards apps can revolutionize personal finance management by encouraging more mindful spending habits.

Users are often incentivized to shop smarter, thereby enhancing their financial literacy while simultaneously reaping rewards. According to a recent survey, savvy shoppers can earn an average of $300 to $500 annually just from using these apps, turning everyday expenses into a mini bonanza.

Maximizing Cashback Potential

To unlock the full potential of these apps, users can adopt several strategies to maximize their rewards. It’s less like hunting for a needle in a haystack and more akin to turning hay into gold. Here are some proven tactics to boost cashback earnings:

- Utilize Multiple Apps: Different apps offer unique rewards for various purchases. By using multiple platforms, users can stack their cashback and reap maximum benefits.

- Pay Attention to Promotions: Many apps feature limited-time offers with increased cashback rates. Keeping an eye out for these can lead to significant bonuses on planned purchases.

- Shop Through App Portals: Many cashback apps provide additional rewards when users shop through their portals. It’s like finding a secret passage that leads to more treasure!

- Link to Loyalty Programs: Connecting cashback apps to existing loyalty programs can supercharge earnings. Users can enjoy double rewards for a single purchase!

- Regularly Review Spending: Monitoring which categories offer the most rewards can help users tailor their shopping habits, ensuring they optimize their cashback potential.

Implementing these strategies not only enhances the earning potential but also fosters a proactive approach to spending. Remember, it’s not just about saving a few bucks; it’s about making every dollar work harder for you!

Future Innovations and Technology Integration: Cashback And Rewards Apps 2025

As we gaze into the crystal ball of 2025, the landscape of cashback and rewards apps is set to undergo some dazzling transformations. We’re not just talking about mere updates; we’re on the brink of a tech renaissance that will redefine how users engage with their finances. With innovations that blend convenience with a sprinkle of magic, the future looks not just bright but positively glittering! The integration of advanced technology in cashback and rewards apps will elevate user experiences and loyalty to unprecedented heights.

Expect to see features that feel like something out of a sci-fi movie—think predictive algorithms that know your shopping habits better than your best friend.

Integration of AI and Machine Learning, Cashback and rewards apps 2025

The future of cashback and rewards apps will heavily lean on the prowess of artificial intelligence and machine learning. These technologies will not only enhance efficiency but will also personalize the user experience to a level that feels almost telepathic. Imagine a scenario where your app recognizes your penchant for coffee every Friday morning and automatically offers a special cashback deal at your favorite café.

This level of personalization goes beyond mere convenience; it fosters a deeper connection between users and brands. Here are key ways AI and machine learning will shape user experiences:

- Dynamic Offers: Algorithms will analyze past purchase behaviors to present tailored offers that are too good to resist.

- Real-time Notifications: Users will receive instant alerts on cashback opportunities based on their current location, turning shopping into a treasure hunt.

- Predictive Insights: Users can expect forecasts of their spending habits, allowing them to optimize their savings before they even hit the checkout.

“Cashback and rewards will become as personalized as a barista remembering your name and your go-to coffee order.”

Role of Blockchain Technology

As we embrace the digital age, blockchain technology is poised to play a crucial role in enhancing the security and trustworthiness of cashback and rewards apps. The decentralized nature of blockchain instills a level of transparency previously unattainable in financial transactions. In an era where data breaches are more common than bad hair days, blockchain offers a solution to keep user information safe.

Here’s how it will reshape the landscape:

- Enhanced Security: Each transaction will be recorded on a secure ledger, making it nearly impossible for fraudsters to tamper with or hack personal data.

- Trustworthy Transactions: Users will be able to verify the legitimacy of cashback offers and rewards, reducing the chance of scams.

- Smart Contracts: These automated contracts will ensure that cashback is triggered only when specific conditions are met, streamlining the rewards process.

“Blockchain technology will be the fortress guarding your cashback treasure chest.”

With these innovations on the horizon, cashback and rewards apps are set to become not just tools for spending but essential partners in financial wellness, guiding users toward smarter spending decisions while sprinkling a little joy in their shopping escapades!

Marketing Strategies for Cashback and Rewards Apps

In the wild world of cashback and rewards apps, standing out is no small feat. As the competition heats up faster than a microwave burrito, effective marketing strategies become the secret sauce that sprinkles a little magic on user acquisition and retention. With the right tactics, apps can transform casual users into loyal advocates, creating a community that revels in the thrill of saving cash while shopping.

Leading cashback and rewards apps have discovered innovative ways to capture attention and engage users. These strategies encompass a mix of traditional marketing techniques and cutting-edge digital tactics, ensuring that potential users are not just aware of an app, but are eager to download it.

Effective Marketing Techniques

To truly engage users and drive app downloads, cashback and rewards apps have embraced a variety of promotional tactics. Here are some standout methods that have proven effective:

- Referral Programs: Harnessing the power of word-of-mouth, many apps offer incentives to current users who refer friends. For instance, “Give $10, Get $10” programs are enticingly popular, turning users into brand evangelists.

- Exclusive Deals and Offers: Limited-time promotions or exclusive offers can create urgency. Apps might partner with retailers to provide users with unbeatable deals, making their cashback rewards feel even more enticing.

- Gamification: Incorporating game-like elements, such as challenges or reward tiers, keeps users engaged. Apps that allow users to earn badges or achieve status levels can turn mundane shopping into a competitive sport.

- Seasonal Campaigns: Tailoring marketing efforts around holidays or special events can significantly boost engagement. For example, back-to-school promotions or holiday cashback boosts can appeal to shoppers looking for deals during peak seasons.

- Email Marketing: Regularly sending personalized emails that highlight new offers, cashback opportunities, or user milestones helps keep users informed and engaged. A clever subject line can be the difference between a click and a ‘delete.’

Role of Social Media Influencers

When it comes to promoting cashback apps, social media influencers have taken the spotlight, effectively bridging the gap between brands and consumers. These modern-day digital wizards wield the power of persuasion, and their endorsement can catapult an app from obscurity to popularity in no time.Influencers often create engaging content that showcases how they use these apps in their daily lives.

Picture an influencer sipping on a pumpkin spice latte while casually mentioning that they just earned 5% cashback on the purchase. This not only humanizes the app but also makes it relatable and desirable to followers.Moreover, brands collaborate with influencers to run promotional campaigns, such as unique discount codes or special cashback offers exclusive to the influencer’s audience. This not only incentivizes downloads but also fosters a sense of community around the brand.In a world where trust is currency, a recommendation from a beloved influencer can lead to conversions that traditional advertising could only dream of.

It’s a win-win situation, where influencers get to share money-saving tips while cashback apps get the much-desired visibility and downloads.

Challenges and Limitations

Navigating the world of cashback and rewards apps can feel like diving into a treasure chest, only to discover a few pesky crabs scuttling around. Despite their shiny allure and promise of savings, these apps come with challenges and limitations that users often encounter. Understanding these hurdles is essential for making the most of your cashback adventures without stepping on a financial landmine.One of the primary challenges users face is the complexity of redemption rules.

While the concept of earning rewards sounds delightful, the fine print can be as confusing as assembling IKEA furniture without instructions. Many users find themselves scratching their heads over expiry dates, minimum redemption thresholds, and intricate tiers of rewards. Additionally, apps often require linking various accounts or credit cards, which can lead to security concerns and even a headache trying to keep track of which card earns what.

Common User Challenges

Users often find themselves grappling with several common obstacles when using cashback and rewards apps. These challenges can hinder the overall enjoyment and effectiveness of the rewards system. Here are some of the key difficulties:

- Complex Reward Structures: Many apps feature convoluted reward systems that can confuse users. Understanding how to maximize earnings often requires a degree in advanced mathematics.

- Limited Merchant Partnerships: Users may discover that their favorite stores are not included in the cashback program, leading to feelings of betrayal akin to finding out your favorite ice cream flavor has been discontinued.

- Low Cashback Rates: While some apps boast high cashback rates, these can often be deceiving. Users might find that the actual return is minimal, like getting a single penny for every hour spent searching for deals.

- Redemption Restrictions: Many users experience frustration when trying to redeem their rewards, as some apps impose strict conditions that feel like trying to crack a safe with no combination.

- Account Linking Issues: Users may struggle with linking bank accounts or credit cards, leading to missed cashback opportunities that could have funded a delightful pizza night.

Limitations of Cashback and Rewards Systems

While cashback and rewards systems can be a boon for savvy shoppers, they also come with notable limitations that can dampen enthusiasm. Recognizing these limitations can help users take informed steps in their cashback journey.The foremost limitation is that many cashback apps come with caps on how much can be earned within a specific timeframe. This often feels like a personal cap on your spending prowess.

Additionally, the rewards can sometimes be a mere illusion, with users realizing that the effort put into earning cashback often outweighs the actual monetary benefits. Moreover, the rewards are typically only applicable to specific categories or purchases. This can lead to a situation where users are encouraged to spend more just to earn more cashback, effectively negating the original intent of saving money.

“Spending to save is like trying to lose weight by eating donuts—counterproductive at best!”

Potential Regulatory Challenges

As cashback and rewards apps continue to flourish, they may face a range of regulatory challenges that could impact their operations and user experience. The evolving landscape of financial regulations could lead to increased scrutiny over the practices of these apps.Data privacy concerns are a significant issue, as many apps collect sensitive user information to tailor offers. Stricter regulations could impose limits on data usage, affecting how effectively apps deliver personalized rewards.

Furthermore, transparency around fees and terms of service may become a focal point for regulators, leading to requirements for clearer communication and fairer practices. In addition, the potential for changes in taxation laws regarding cashback earnings could catch users unaware, transforming a simple savings app into a confusing tax nightmare. Imagine receiving a 1099 form for your cashback rewards—now that’s a plot twist no one saw coming!

Predictions for the Cashback and Rewards App Market

As we gaze into the crystal ball of cashback and rewards apps, the future looks as sparkling as a freshly polished dime! By 2025, the market is expected to experience remarkable growth, driven by a surge in consumer interest and technological advancements. It’s as if these apps are the popular kids in school, and everyone wants to be their friend.

Market analysts predict that the cashback and rewards app sector could balloon to over $100 billion, thanks to the increasing number of users who are becoming savvier about maximizing their spending. The trend toward online shopping, particularly post-pandemic, plays a significant role in this projected growth. With more people turning to digital platforms for their shopping, cashback apps will be the trusty sidekicks helping them save money—and who doesn’t want to save a buck or two while shopping for that cozy sweater?

Emerging Market Trends Influencing User Behavior

Several trends are poised to shape how users engage with cashback and rewards apps in the coming years. Understanding these will be crucial for app developers and marketers looking to capitalize on this booming market.The rise of personalized shopping experiences is transforming user expectations. Apps incorporating advanced algorithms to analyze spending habits and offer customized rewards will likely capture the attention—and wallets—of users.

Additionally, social commerce is on the rise, allowing users to share deals and earn rewards through social networks. This creates a sense of community, making shopping feel like a fun group activity rather than a solitary task.Here are key factors contributing to the success of cashback and rewards apps in the next few years:

- Increased Competition: As more players enter the market, apps will need to differentiate themselves with unique features and better rewards.

- Integration with E-commerce Giants: Partnerships with major retailers can provide users with exclusive deals, making these apps indispensable.

- Mobile Payment Integration: The seamless merging of cashback apps with popular payment methods will enhance user convenience and boost adoption.

- Sustainability Trends: Eco-friendly incentives, like rewards for sustainable purchases, are likely to resonate with socially conscious consumers.

In this rapidly evolving landscape, the apps that adapt and innovate will thrive, leaving behind those that cling to outdated methods like a cat clinging to a tree branch. The next few years promise exciting developments, making cashback and rewards apps not just a financial tool, but a vital part of the shopping experience.

Final Wrap-Up

As we wrap up our exploration of cashback and rewards apps 2025, it’s clear that these digital companions are not just about saving a few bucks; they’re about revolutionizing how we manage our finances and interact with the marketplace. So get ready to turn every mundane purchase into a rewarding adventure—because who wouldn’t want to be rewarded for simply living their life?

FAQ Resource

What are cashback and rewards apps?

They are applications that offer users money back or rewards points for purchases made through their platform, turning everyday spending into savings.

How do I maximize my rewards?

Use multiple cashback apps, take advantage of special promotions, and always check for bonus offers before making a purchase.

Are cashback apps worth it?

Absolutely! With the right usage, you can accumulate significant savings and rewards over time, making every penny count.

Will these apps have fees?

Some apps may have fees, but many offer free access to their cashback services. Always read the fine print!

Can I use multiple cashback apps together?

Yes, using multiple apps can increase your rewards potential, but be sure to check compatibility with retailers.